You run your business, we run your payroll. It's as simple as that.

You did not start your business in order to be bogged down with legislation, ever changing rules, and the possibility of substantial financial penalties for non-compliance of mandatory processes and submitting information to HMRC.

Our

People

Our

Software

Your

Solution

Reasons to Outsource your Payroll

- Free up your resources so that your staff can concentrate on other essential tasks

- Save employer costs associated with employing specific payroll staff - salaries, employer NI, employer pension and holiday pay

- Save on payroll software and payroll training costs

- Saves you time and hassle involved with payroll

- We remain up to date with all new legislation so that you don't have to, ensuring security and compliance at all times

- We have all the resources to meet the demands of payroll processing

- Assurance of your employees being paid, even when your office staff are absent due to holiday or sickness

- You can be worry-free when it comes to your payroll

Payroll Issues to Consider

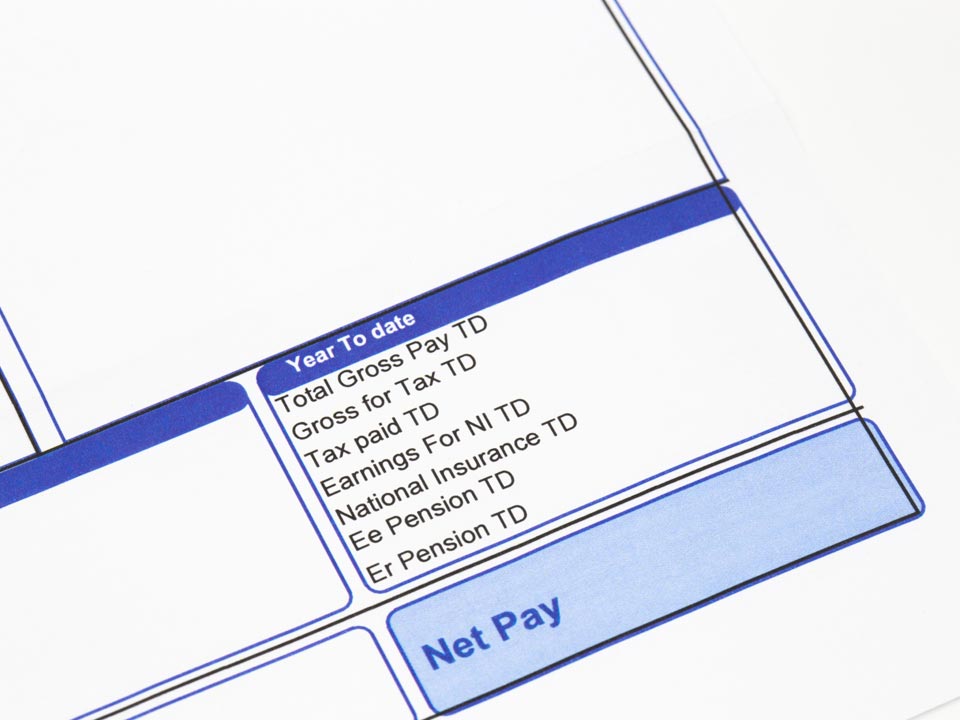

Payroll is no longer just a matter of deducting Tax and National insurance and paying the employees their net pay.

There are now different tax rates and thresholds for Scottish residents, deduction of Student loans (again, different rules for Scotland) and post graduate loans.

Add to this the frequently changing rules on statutory pay (sick / maternity / paternity / shared parental / bereavement) and of course the requirement for mandatory RTI files to be submitted to HMRC for each payroll.

As if that is not enough, payroll also has the National Minimum Wage / Living Wage, holiday pay legislation and auto enrolment pensions to consider.

Make it Easier for Your Business

You are expected to have the necessary skills to run your business, you should not also be expected to know all the detailed legislation that goes into processing payrolls correctly.

Payroll should not be taxing for you. It can be difficult to keep up with the ever-changing legislation, especially if you do not have a dedicated payroll resource in-house.

The financial penalties for getting things wrong can be extensive by way of fines from HMRC and The Pensions Regulator, and ignorance is no defence if things do go wrong due to lack of knowledge or resources.

Save money on your payroll costs

If your payroll is currently in-house, have you considered the total cost of processing your payroll?

- Payroll staff salaries

- Employer’s National Insurance

- Employer’s Pension contributions

- Holiday pay

- Temporary cover for holidays and sickness (and the danger of sickness absence when your payroll is due)

Add to this your payroll software costs and consider if it will be more cost effective to outsource your payroll to our professional payroll team.